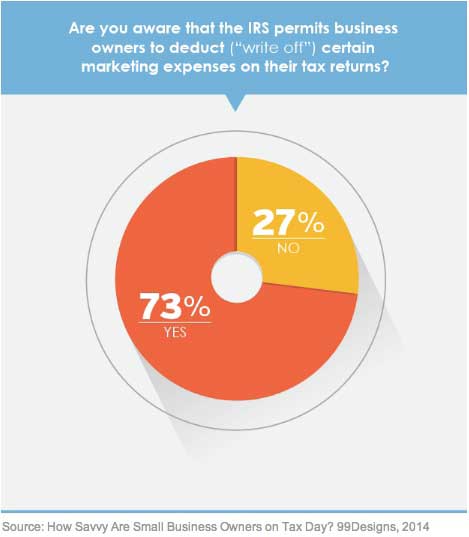

Tax Day is (thankfully) in our rear-view, but that reminds us: Did you know that marketing expenses geared towards increasing the total number of customers you have can be written off? If not, you’re not alone. More than 27% of small business owners were unaware that certain marketing efforts could be written off.

Keep that in mind for your next fiscal year. Maybe that campaign you’ve been thinking about is a little more affordable than you thought it was.

27% of SMBs Unaware of Marketing Tax Deduction

by Ayaz Nanji | April 15, 2014

More than a quarter (27%) of US small business owners are not aware that the IRS allows them to deduct certain marketing expenses from their taxes, according to a recent report from 99designs.

More than a quarter (27%) of US small business owners are not aware that the IRS allows them to deduct certain marketing expenses from their taxes, according to a recent report from 99designs.

However, of the 73% who are aware of the deduction, just more than half (57%) say they are taking advantage of it on their 2013 tax return.

Nearly two-thirds (64%) of the small business owners deducting marketing expense say they are writing off about the same amount this year as on their 2012 return, 22% are deducting more, and 14% are deducting less.

Below, additional key findings from the report, which was based on data from an online survey conducted on April 3, 2014 among 211 US-based small business owners.

- Asked what they would do if they received a $500 tax refund to put toward a single marketing channel, 33% of respondents say they would spend the money on their website.

- 17% say they would put a $500 refund toward Internet advertising, 14% would spend it on a mobile app, and 10% would invest it in a print ad campaign.

Marketing Spend

- 70% of respondents with marketing budgets say the money they spent in 2013 was a good investment, whereas just 7% say it wasn’t. The remaining 23% say they are not sure yet.

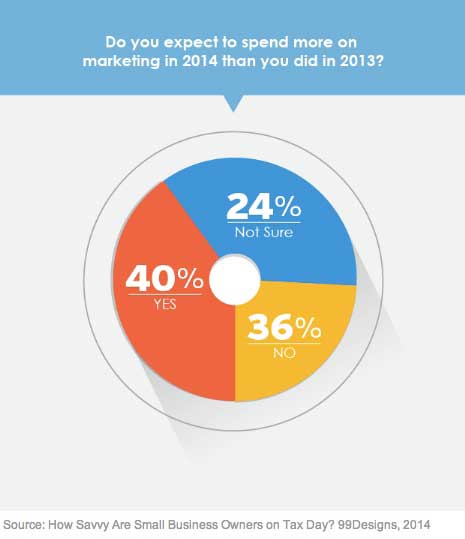

- 40% of respondents plan to spend more on marketing in 2014 than they did in 2013, 36% do not plan on spending more, and 24% are still not sure.

About the research: The report was based on data from an online survey conducted on April 3, 2014 of 211 US-based small business owners.